CA Form 587 2011 free printable template

Get, Create, Make and Sign CA Form 587

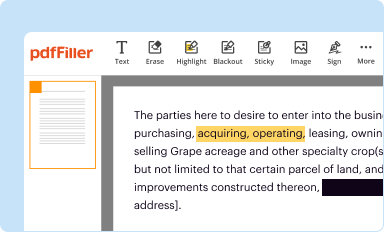

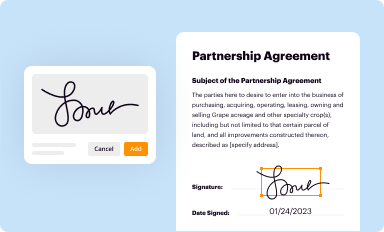

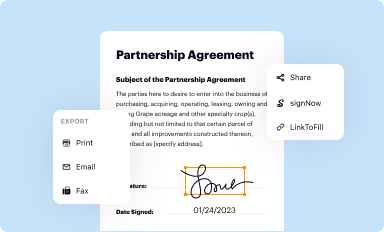

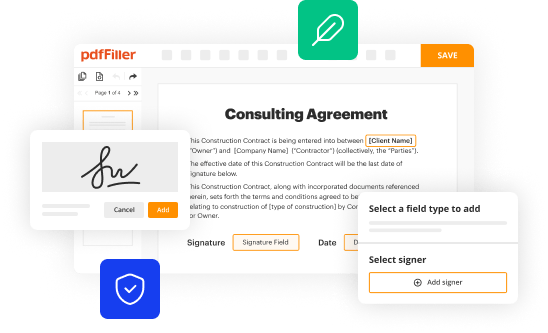

Editing CA Form 587 online

CA Form 587 Form Versions

How to fill out CA Form 587

How to fill out CA Form 587

Who needs CA Form 587?

Instructions and Help about CA Form 587

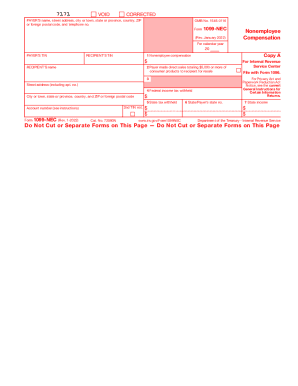

How to Fill Out IRS Form 941 Hi everyone, I'm Priyanka Prakash, senior staff writer at Fund era. Today I'll show you how to fill out IRS Form 941. Form 941 is a form that businesses file quarterly to report withheld income taxes from their employees’ wages, as well as the employer and employees share of Social Security and Medicare taxes, which are together called FICA taxes. In general, if you'll be paying wages of more than $4,000 per year, giving you a tax liability of more than $1,000 per year, then you'll need to submit Form 941 on a quarterly basis. Let's get started with the form. To begin, indicate the quarter for which you're filling the form out. Form 941 is due on the last day of the month following the period for which you're filing. For example, you’d file the form by April 30 to cover wages paid in January, February, and March. The other deadlines are July 31, October 31, and January 31. In this case, I'm going to choose option 1. I'm filing by April 30 to cover wages paid in January, February, and March. Then, you'll type in or right in your hand filling the...

People Also Ask about

Where to get California state tax forms?

Who fills out form 587?

What is the difference between form 587 and form 590?

What is CA 587 form 2019?

Do I need to fill out form 587?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my CA Form 587 directly from Gmail?

How do I complete CA Form 587 online?

How do I edit CA Form 587 in Chrome?

What is CA Form 587?

Who is required to file CA Form 587?

How to fill out CA Form 587?

What is the purpose of CA Form 587?

What information must be reported on CA Form 587?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.